Table of Content

But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you. In 2018, the typical U.S. home spent between 65 and 93 days on the market, from listing to closing.

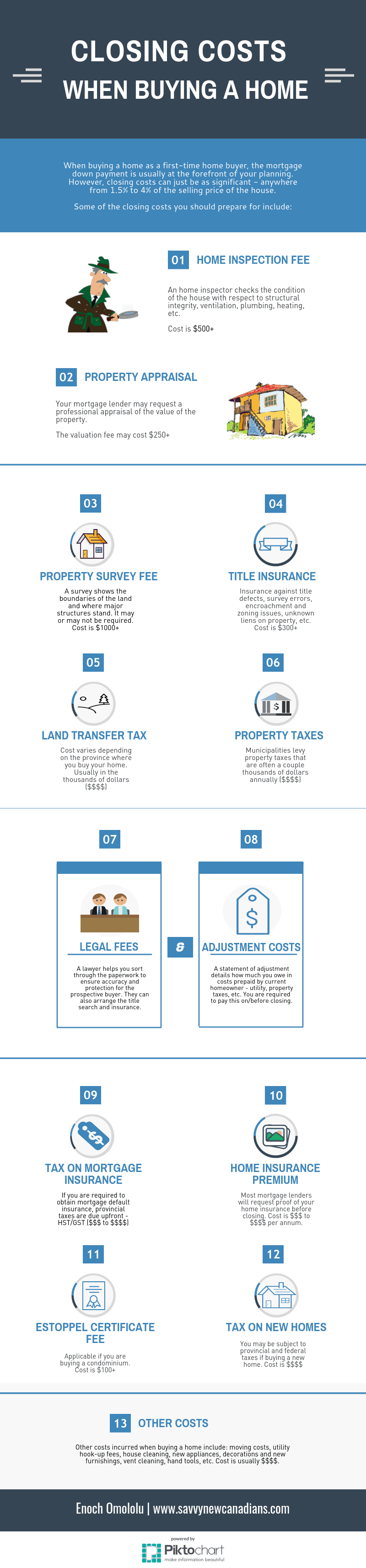

If you’re buying a home from a family member or friend, you may want to ask them what percentage they paid in property taxes last year. This will give you the best estimate of what you’ll owe in property tax closing costs. In some states, you can’t close on a housing loan without an attorney. Attorney fees cover the cost of having a real estate attorney coordinate your closing and draw up paperwork for your title transfer.

A Guide To Real Estate Closing Documents For Buyers

If you’re not ready to apply for a loan but want to get a feel for how much you can afford, check out Zillow’s affordability calculator. You can also simply multiply a home’s sale price by 2% to get your minimum closing cost amount or 5% to get the high end of your potential closing costs. A lot of factors impact how much you’ll pay in closing costs.

Real estate agents or Realtors on both sides of the transaction make money on the sale, which comes out of the seller’s pocket. How much is charged is based on a percentage of the final sale price of the home. Your lender expends time and effort to set up your specific mortgage, so that cost is charged to you as a percentage of the total loan. Acting as your own agent, known as listing for sale by owner or FSBO, can help you avoid commission fees and hang on to more of your home’s sale price.

Average Closing Costs: What Will You Pay?

It may include your credit check or home appraisal, depending on the lender. Not all lenders charge an application fee and you may be able to get it discounted or waived. VA loan closing costs range between 1% and 5% of the total loan amount.

Title insurance protects buyers and lenders in case there are problems with the title in a real estate deal. Closing cost responsibilities are negotiable, and offering to help the buyer cover their closing costs can be a valuable bargaining chip. While sellers can cover their closing fees out of the sale proceeds, buyers must pay theirs out of pocket. Sometimes referred to as reserve fees or prepaids, escrow funds hold reserved money for property taxes, premiums, homeowners insurance and mortgage insurance. The lender then uses the escrow funds to make payments on your behalf as part of your regular mortgage payment.

How can I estimate closing costs?

Nonetheless, this does not mean that you cannot opt for independently chosen vendors. Most buyers hire real estate attorneys when the real estate transaction is unusual or complex. Some instances of these are joint ownership of the house, private loans from family or friends, the presence of easements on the property, etc. However, you can hire an attorney even if your transaction is not unusual. Usually, lenders hire an appraiser to determine the fair market value of the property the buyer wants to purchase.

This money goes to the Federal Emergency Management Agency, which uses the data to plan ahead for emergencies and to target high-risk zones. This closing cost only applies if you’re buying a house in a flood zone or you. Courier fees cover the cost of transporting mortgage documents. Expect to pay around $30 in courier fees if your lender charges them.

Tax Monitoring And Tax Status Research Fees

If you're concerned about receiving marketing email from us, you can update your privacy choices anytime in the Privacy and Security area of our website. We ask for your ZIP code because we need to know your time zone so we can call you during the appropriate business hours. Based on the information you have provided, you are eligible to continue your home loan process online with Rocket Mortgage. Transfer taxes are usually expressed as a set number of dollars per $100,000 of the home’s appraised value. Use these documents to find the best deal, and you could save thousands over the life of your loan.

If you work with a realtor, they'll provide a yard sign themselves. However, if you decide to go the for sale by owner route, you'll need to buy your own sign, which will cost you $40–60 for a basic sign with space to write your own information. Staging can be as small as cleaning your house and putting out a few decorative items to make the place more homey. Or you can have a professional stage your home to make it as appealing as possible to prospective buyers.

Shopping for a mortgage is about more than just an interest rate. Here’s an example of how discount points and rebate pricing might compare for a $250,000 home loan. This can prove challenging for home buyers on a tight budget. You’re never committed to a mortgage until you sign — so before you do, make sure you’re getting the deal you were promised. Check your buying power by getting pre-qualified for a mortgage with us at Zillow Home Loans.

If you're looking to sell your home, you should be aware the process isn't free. The national average cost to sell a house is $32,555; most homeowners can expect to pay about 9.10% of their home's sale price in selling costs. Transfer taxes are a big factor, especially in states with high transfer taxes.

If you have a home equity loan or line of credit, in addition to your mortgage, the lender will require this be paid in full at settlement as part of closing costs for the seller. However, offering to cover a portion of the buyer's fees can help sellers close a deal. What real estate closing costs actually apply to your home sale will vary by location, and how you divide them with the buyer often depends on local conventions. Your realtor can help you determine which fees and taxes will be your responsibility, as well as what they generally cost in your area.

If you’re buying a home built before 1979, it might have lead paint. Lead-based paint poses a significant health risk to both adults and children living in a home. Your fees for any discount points will appear on your Loan Estimate under Origination Charges. Compensation may impact the order of which offers appear on page, but our editorial opinions and ratings are not influenced by compensation. So if you plan to stay in the house 6 years or more in this scenario you’re actually losing money with rebate pricing. You can choose the fee structure that works best for your financial situation.

The average cost of a deep clean before moving is $151, though this can vary depending on the size of your house and the amount of work necessary. However, not all improvements are a good idea before selling. Avoid changes suited to your personal preferences or ones with a low return on investment. For example, fancy landscaping may appeal to you, but it might not be worth the additional cost to buyers. Michele Lerner writes about real estate, personal finance, and business news.

No comments:

Post a Comment